Deciding whether or not to make a claim on your insurance, isn’t always as simple as it may seem. As a general rule of thumb, you shouldn’t automatically disregard the impact claiming could have on your future premiums. To help you decide, check out our step by step guide below on how to handle this type of situation.

Should you report minor accidents to your insurer?

You don’t necessarily have to claim, but the truth is, your insurance provider will need to know about any accidents that you have in your car, minor or not, fault or non-fault. At the end of the day, an accident is an accident and that technically means that you’re at a higher level of risk.

If you decided not to tell your insurer, let’s say for example you have a little bump, and you don’t tell them, and then later on down the line, you accidentally have something else happen and you need to make a claim.

When the time comes for an inspection of your car, if the mechanic finds more damage than there should be from other minor incidents that you’ve had, you could be in for a nasty surprise if you haven’t told them about your other incidents. The worst-case scenario is that your insurance could become invalid, meaning that you’d have to fork out for your repairs instead.

If you did decide to keep your accident on the down-low and not inform your insurer, the chances are that the third party might, and you don’t want that. Surely, it looks better coming from you than someone else, right?

Does your insurance increase if you

don’t make a claim?

If you’ve found yourself involved in

an accident, there’s no need to worry about the cost that your insurer has paid

out for you for any repairs, because you haven’t claimed.

Sadly, that doesn’t matter. Likely, you’ll still be considered as a higher risk than you were and this

could potentially affect your premium. Think about it, every little bump and

tiny scratch, helps insurers build up a picture of your driver profile. This

profile is a key piece of information for insurance providers, which is why this

information is shared with them from the motor insurance database.

That profile determines whether you’re

at a level of risk on the road. The higher the risk you are, the higher expensive your premium is more than likely going to be, simple. You can’t

expect anything less. So long as you’re honest and upfront with your insurer

from the onset, you shouldn’t have anything to worry about.

How long do you have to claim your insurer?

Generally, you should contact your insurer as soon as it is safe to do so after an accident. Preferably within 24 hours if you can, any longer than that, and it may invalidate your policy.

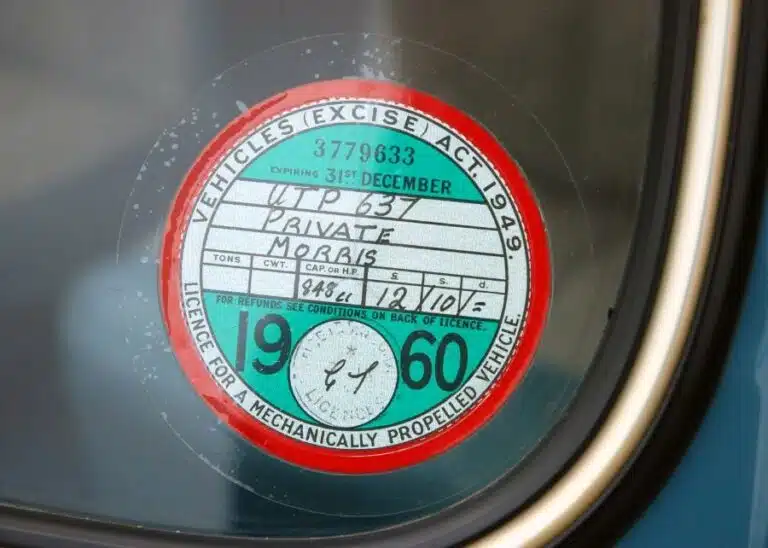

Insurers usually set out a timeframe of how long you have to notify them after an accident, so it might be worth checking out your terms and conditions in your policy documents to get an exact timeframe.

Things to consider before making a claim

When you’re debating whether or not you should claim your insurance, you might want to mull over some of these:

- Do you have a No Claims Discount? If the answer is yes, then you might risk losing these in the event of a claim. Think about how much you have saved over the years on your premiums thanks to the no claims bonus that you have.

- What is your excess? Have you checked how much voluntary excess you’ll have to contribute if you make a claim? Sometimes, you might even find that your actual repair costs could be less than the excess you have to pay! Crazy, isn’t it?

- Is it worth the hassle? Claims can be a long process and you’re probably thinking that you just don’t have the time and energy for it. Complicated is an understatement but it could be worth it still.

How to make an insurance claim

If you’ve had a theft or a major accident with your vehicle, you can bet that this will nearly always lead to a claim. There’s probably nothing you can do about it and this probably going to be your only option at this point.

If you find yourself in this situation, you’ll need to pick up the phone and let your insurance provider know.

Are you mid-policy or at the renewal stage? Either way, you’ll just need to contact the claims team and let them know what happened. You can let them know whether or not you are claiming or just notifying them.

If you’re wanting to make a claim, the claims team will make a note of this so that have all of your up-to-date information. Your main concern here is going to be whether or not this will affect your premium. The answer is yes. In almost every instance, it will and that’s just the way it is. There’s no way around it. Whether you’re at fault or not, it’s probably going to affect your price, even if it’s just a small increase.

The only exception to the above is if you’ve had a windscreen incident or lost your keys. That’s when you might be safe and have escaped any increase in pricing, but this will depend on your insurer.

Each insurance provider will likely have their process for reporting a claim, and generally, how it goes, is that you’ll let them know about the incident, supply all the relevant details and they’ll get back to you with the changes.

How long does a claim take to settle?

We wish that we could say it didn’t take long, but sadly, this all depends on how complex your claim is. For example, if you’ve been hit by a third party and they have admitted fault, that’s great! It might only take a few weeks for this to be settled.

Your claim could take longer to settle, possibly even months if no one accepts liability for the accident. This can be a real pain and can stretch out the length of time it might take for you to get a payout.