Here is a run down of some of the main things that you might want to consider.

How do I sell my company car?

Some of the things you should consider when selling a company car are:

- The ownership and authority of the car. You need to have a written letter of authority from the company and confirm with them that you have permission to sell the car, according to Mile IQ.

- The outstanding finance of the car. You cannot sell the car if the company still owes money to the lender.

- The tax implications of the sale. You or the company may have to pay corporation tax, capital gains tax, or income tax on the profit or the benefit in kind of the car.

- The best option for selling the car. You can sell the car privately, to a dealership, at an auction, or to a car buying service, but each option has its pros and cons.

- Prepare your car for sale, giving it a clean and fixing it up if needed. Price it fairly, using a car valuation. Make sure you have the right paperwork. Create an eye-catching advert for your car. Arrange to meet a potential buyer. Arrange a test drive. It can be as easy as that!

There are various options for selling a company car, such as selling it privately, to a dealership, at an auction, or to a car buying service. However, each option may have different advantages and disadvantages, so it is advisable to do some research and compare the offers before making a decision. You may also want to consult your accountant or a tax adviser for more guidance on the tax implications of selling a company car.

Tax implications of selling a company car?

You may need to pay tax on the sale of a company car if you or the company make a profit from the sale or if you use the car for personal purposes. The type and amount of tax you pay depends on whether you are a sole trader, a limited liability company, or an employee. Some of the taxes that may apply are:

- Corporation tax or capital gains tax on the profit or loss from the sale of the car

- Income tax on the benefit in kind of the car if you use it for personal purposes

- Value added tax (VAT) on the sale of the car if you are VAT-registered

You may also be able to claim capital allowances on the cost of the car to reduce your taxable profit, according to the Gov.uk. However, the amount of capital allowances you can claim depends on the type and emissions of the car. You should consult your accountant or a tax adviser for more guidance on the tax implications of selling a company car too, they will be able to help.

How will my tax liability be affected if I sell my company car?

Your tax liability will depend on whether you are a sole trader, a limited liability company, or an employee, and whether you make a profit or a loss from the sale of the car. You may have to pay corporation tax, capital gains tax, income tax, or value added tax on the sale of the car, depending on your circumstances.

How to write off the cost of a company car as a business expense

There are two options for writing off the cost of a company car as a business expense: the standard mileage rate and the actual expense method. To use the standard mileage rate, you must use this method the first year the car is used in a business, says Gov.uk. Then in later years, you may choose between the actual and standard mileage methods. The standard mileage rate for 2024 is 58.5 cents per mile.

To use the actual expense method, you must keep track of all the costs related to the car, such as gas, repairs, insurance, depreciation, etc. You can then deduct the percentage of these costs that are attributable to business use, says Raw Accounting. For example, if you use the car 80% for business and 20% for personal purposes, you can deduct 80% of the actual expenses.

You must also consider the tax implications of the sale or disposal of the car, as you or the company may have to pay corporation tax, capital gains tax, income tax, or value added tax on the profit or the benefit in kind of the car, says Block Advisors. You may also be able to claim capital allowances on the cost of the car to reduce your taxable profit, depending on the type and emissions of the car.

What are some tips and tricks on selling a business vehicle?

Selling a business vehicle can be a complex process, as it involves tax, legal, and financial considerations. Here are just a few tips and tricks on how to sell your business vehicle effectively and efficiently, according to Mile IQ.

- Know the value of your vehicle. You can use online tools or consult a professional appraiser to get an accurate estimate of your vehicle’s market value. This will help you price it fairly and negotiate with potential buyers.

- Choose the best option for selling your vehicle. You can sell your vehicle privately, to a dealership, at an auction, or to a car buying service.

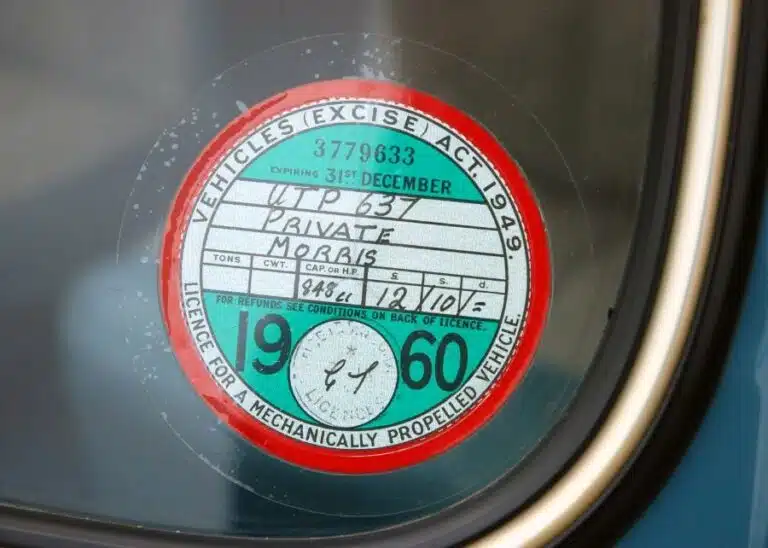

- Prepare your vehicle for sale. It’s always a good idea to give your vehicle a thorough clean and fix any minor issues that may affect its appearance or performance. You should also gather all the relevant paperwork, such as the title, registration, service records, and warranty information. You may also need a written letter of authority from your company if the vehicle is registered to them.

- Create an eye-catching advert for your vehicle. You should highlight the features and benefits of your vehicle, such as its mileage, condition, fuel efficiency, and extras. You should also include clear and honest photos of your vehicle from different angles. You can use online platforms or local media to advertise your vehicle to potential buyers.

- Arrange to meet a potential buyer. It’s a good idea to choose a safe and public location to meet the buyer and show them your vehicle.

Being prepared is key, and allow a potentially buyer to test drive your vehicle too so they can see how amazing it is themselves. Finally, let’s not forget payment. If you can verify the payment method of the buyer before agreeing to the sale, that’s a bonus!