Comprehensive car insurance. Now that’s a term that will get you if you’re not that familiar with it. To find out how you can minimise the amount of stress when your driving, then listen up.

What is comprehensive car insurance?

For those that aren’t familiar with it already, comprehensive car insurance is a type of insurance that covers damage to your car, yourself, and also compensation to a third party if you were to ever be involved in an accident.

Comprehensive car insurance would also cover your vehicle if it was to be destroyed, become dented or crushed. It basically covers everything, even theft, and fire. So when you go out for a drive, it’s lovely knowing that you can be confident knowing that you’re covered if anything terrible was to happen (fingers crossed it doesn’t). It will just give you that peace of mind, which most of us drivers want, right?

There’s no better feeling than being able to head out for a drive knowing that you’re fully covered.

Why choose comprehensive insurance?

When buying comprehensive insurance it means that you’ll be eligible to make a claim should you happen to be involved in an accident that wasn’t your fault.

You can also make a claim if the fault can’t be proven too. For example, let’s say that you returned from shopping to find that your car has been damaged in the car park. It’s a great feeling knowing that you would be covered for this.

If you could save yourself a fortune on having to fork out for car repairs, then why not get yourself covered, or do you want to risk having to pay for repairs? You can give yourself that added bit of protection by just getting yourself the highest level of protection from your insurer.

Is comprehensive insurance more expensive?

Some people can be a little wary when it comes to buying comprehensive car insurance. They think that it might be pricey and have to pay more for it, but if you shop around for it, you could actually bag yourself a great deal!

When you’re comparing your policies it’s definitely worth looking at the difference in price between comprehensive insurance and other policies. In some instances, you might find that comprehensive insurance actually works out cheaper than some other policies.

Now we’ve covered the basics of everything to do with comprehensive insurance and you’re all up to date, let’s have a brief look at some other levels of car insurance too.

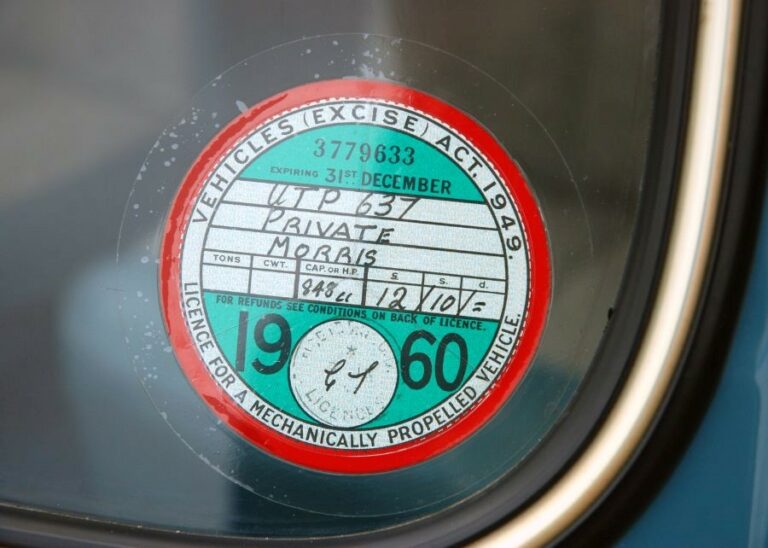

Third party

This type of insurance means that if you were to have an accident that wasn’t your fault, your insurance would only provide compensation to the third party that was involved. However, if your vehicle is damaged, unfortunately, you won’t be able to claim to get it fixed and you’ll have to pay for any repairs yourself. Or if your car is behind repair, we can always help you to scrap it quickly for cash.

Third party, fire and theft

As you might be able to tell, this one is similar to third party, but the only difference is that this type of policy also covers you if your car is stolen or damaged due to fire.

Black box

Black boxes have been around for quite a while now and they are an affordable option for both new and young drivers and a much better option compared to those usual high premiums. It’s basically a telematics device that is installed into your car and provides a picture to the insurance company as to how you like to drive. The safer you drive, the better discount you could get when the time comes for renewal.

Is comprehensive cheaper than third party?

When the time comes to purchasing your new insurance, you might find that comprehensive costs the same amount as third party, if not a little bit more.

It’s not too expensive but it’s definitely worth looking to see what the difference is and weighing up the pros and cons before making your decision.

In some cases, some people just avoid looking at comprehensive insurance altogether as they just think that it will cost more and be too expensive, but that’s not always the case. Don’t write it off completely until you’ve had a good look first.

If you’re getting rid of your car and buying a brand new one, you might also want to know a little more about gap insurance.

Jamjar.com makes selling your car quick, easy, and hassle-free. By comparing offers from a trusted network of UK car buyers, you get the best price without the stress of negotiating or haggling. There are no hidden fees, no obligation to sell, and the entire process is 100% online. Whether your car is nearly new or well-used, Jamjar helps you sell it fast and for a fair price—saving you time and effort.