The bank reported a substantial pre-tax profit of £7.5 billion for 2023, which is a 57% increase from the previous year. Despite this profit, there’s significant uncertainty regarding the potential outcomes of the FCA’s probe, including any misconduct or customer losses that could lead to penalties or compensation payouts, according to The Guardian.

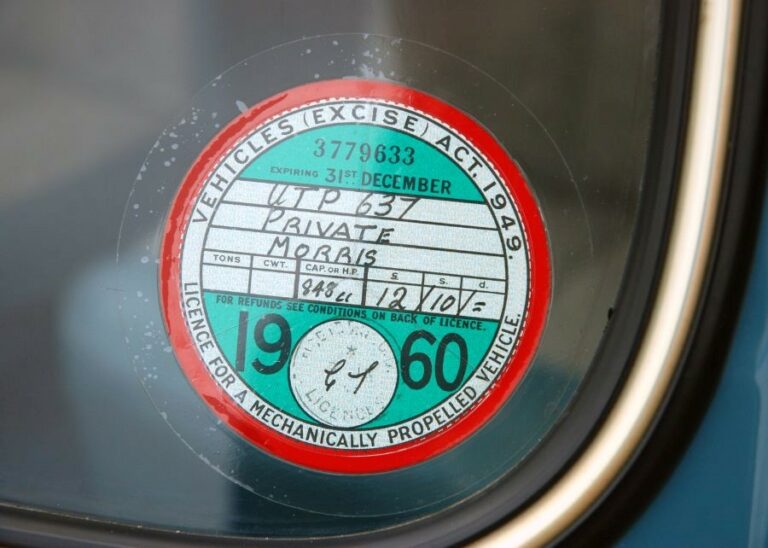

The FCA announced that it would investigate whether people who believe they were charged too much for car loans were owed compensation.

The investigation is centered around whether consumers were charged inflated prices for car loans. According to The Guardian, this action by Lloyds is a proactive measure to cover potential fines and compensation for customers if the investigation concludes that there was wrongdoing.

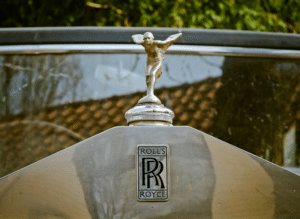

Money Expert, Martin Lewis said last month the investigation by the FCA could lead to “the new PPI” – a reference to the multibillion-pound payment protection insurance scandal – which ultimately ended up costing banks more than £40bn. Lloyds was one of the biggest offenders, with a PPI compensation bill of more than £20bn. It is seen as the most exposed of the major banks to any claims, as it owns one of the UK’s largest motor finance providers, Black Horse, says the BBC.

Lloyds’ chief financial officer, William Chalmers, told reporters that the car finance probe was “not like prior remediations”.

Speaking to the BBC’s Today programme, Lloyds chief executive Charlie Nunn said: “The extent of any misconduct or loss on behalf of customers, if any, remains very unclear so we welcome the FCA’s announcement a few weeks ago to look into this to provide clarity for customers and the industry.”

Matt Britzman, equity analyst at Hargreaves Lansdown, said the £450m set aside by the bank was “less than some had feared but there will be question marks around how Lloyds has come to that figure”.

“Lloyds has been honest in saying the outcome of the review is largely unknown,” he added. “What we do know is that Lloyds is one of the more exposed banks should the FCA deem there was misconduct and customer loss.”

Lloyds also said in its annual report that it was the subject of another investigation by the financial watchdog, looking at the group’s compliance with money-laundering rules and regulations, says the BBC.

It said it was fully complying with the investigation, although it could not say whether or not it would have an impact on its finances yet.

The FCA declined to comment on the investigation.

What to do if you think you are owed compensation for your car finance

According to the BBC, claims for compensation can be made if you bought a motor vehicle on finance before 28 January 2021 and the finance provider and car dealer had a discretionary commission arrangement.

If you believe you are owed compensation for your car finance, here are some steps you can follow:

- Review Your Agreement: Check your car finance agreement to understand the terms and conditions, especially regarding interest rates and commissions.

- Gather Evidence: Compile any relevant documents, such as payment records or communications with the finance provider.

- Contact the Finance Provider: Reach out to your car finance provider to discuss your concerns. Lloyds Banking Group, for example, has set aside funds for potential compensation related to motor finance, says The Guardian.

- Use Available Tools: Consider using tools designed to help you determine if you were overcharged. MoneySavingExpert.com has a template email generator for this purpose.

- File a Complaint: If you’re not satisfied with the response from your finance provider, you can file a formal complaint with them.

- Contact the Financial Ombudsman Service: If the issue is not resolved to your satisfaction, you can escalate your complaint to the Financial Ombudsman Service.

- Stay Informed: Keep an eye on updates from the FCA, as they may set up a formal redress scheme depending on the outcome of their investigation.

The exact process may vary depending on the outcome of the FCA’s investigation and any specific procedures put in place by your finance provider. It’s important to act promptly and keep records of all your interactions throughout the process.

You can read guidance on motor finance complaints on the Financial Ombudsman site here, and guidance from the Financial Conduct Authority here.