When applying for a new car loan, consider the following tips:

Set a fixed budget

Determining your budget and calculating how much you can afford to borrow comfortably when applying for a car loan is a good place to start. According to Carmoola, they say to consider not only the monthly payments but also other costs like insurance, fuel, and maintenance.

Your budget is key and your guide to understanding how much you can afford. You can use a car loan calculator says Bank Rate, to experiment with loan amounts and rates to find an affordable monthly payment.

It’s also worth thinking about the vehicle upkeep too, as it’s more than just the monthly loan payment. It includes fuel costs, insurance, vehicle add-ons and any trips to the mechanic — expected or otherwise. Experts recommend keeping your monthly car-related expenses at or below 20 percent of your take-home pay.

Find the best rates

I went to the shops and I bought…a new car! Shop, shop and shop until you drop. Shop around for car loans and compare interest rates and also the terms from different lenders. Credit Karma recommends looking for competitive rates and favorable loan terms that suit your financial situation.

You can always request quotes from multiple lenders to compare the best offers for you. This helps you find the best deal and ensures you’re getting competitive rates.

Negotiate the price

So you’ve found a car that you like the look of, your armed with your budget so now you can make a well-informed car purchasing decision. So what next?

You can confidently approach car dealerships and negotiate the best deal possible, ensuring that your dream car becomes a reality without breaking the bank.

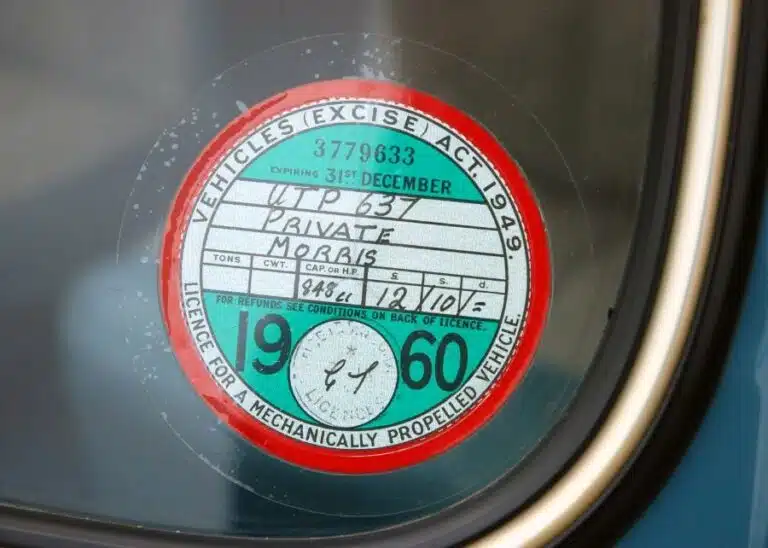

Know your credit score

Did you know that lenders evaluate your car loan application based on your credit report and score? Ensure your credit history is accurate and dispute any errors you find, says Carmoola.

Different lenders use varying scoring systems, which makes it challenging to pinpoint an exact credit score requirement. However, here are some general guidelines:

- Minimum Credit Score:

- Lenders typically require a credit score of at least 660 to qualify for a car loan, according to Clear Score.

- Some lenders may accept lower scores if you have a co-signer.

- Credit Reference Agencies and Scoring Systems:

- Equifax uses a scoring system between 0 and 700, with the UK average around 380.

- TransUnion (previously known as CallCredit) has a system ranging from 0 to 710, with the UK average around 610.

- For example, a score of 550 would be considered good with Equifax but below average with TransUnion, according to Equifax.

- Individual Circumstances Matter:

- Remember that your credit score is just a guideline.

- What truly matters is the contents of your credit history.

- Lenders consider other factors too, such as income, employment stability, and debt-to-income ratio.

In summary, while knowing your credit score and keeping it healthy is helpful, there are also lenders out there who may consider your overall financial situation too when applying for a car loan, which is even better.

Choose a shorter loan period

If you can, it might be an idea to save up as much as you can for a new car loan deposit. This is because a higher deposit reduces the amount you need to borrow, which can lead to lower monthly payments. So if you can aim to contribute as much as possible upfront, the better chance you’ll have for having a shorter loan period.

The shorter the loan term, the less interest over the life of the loan, it’s a win-win! Doing it this way, you can save money and you’ll own the car outright sooner than you might have first thought.

Avoid extra add ons at the dealership

When purchasing a car, it can be overwhelming, exciting, and you might fall down the rabbit hole with trying to navigate the world of dealer add-ons as it can be confusing and costly.

These extra features, services, or accessories may be presented as essential or highly beneficial, but they often come with a hefty price tag.

Here’s how to challenge dealer add-ons and avoid paying for unnecessary extras, ultimately saving you money on your new vehicle purchase:

- Ask to see the products contract:

- Once you’ve looked at the contract, you could accept it, reject it, or amend it.

- Push back:

- Any add on product is voluntary and not necessary and You’re not obligated to accept these extras if you don’t want to.

- Be ready to walk away:

- Always be ready to walk away if you don’t want to sign a contract, you’re not forced to sign for any extras if you don’t want any.

You’re in control during your car buying process and if things don’t align with your budget, you don’t need to buy them.

Lock in your financing

When securing a car finance agreement, it’s essential to lock in the terms and fully comprehend the contract. Let’s break it down:

- Get Preapproved:

- Before car shopping, get preapproved for a loan of you can. This helps you lock in a better interest rate. This will help you to know your budget and then you can negotiate confidently.

- Understand the Loan Agreement:

- It’s all about the contract so it’s always a good idea to read it thoroughly. It outlines the terms, conditions, and obligations.

- Some of the key components include:

- Loan Term: The duration to repay the loan. Longer terms mean lower monthly payments but more interest over time.

- Monthly Payments: Calculate based on the principal amount, interest rate, and term.

- Fees: Watch out for organization fees, prepayment penalties, and late fees.

- Collateral: The car secures the loan. Timely payments prevent repossession.

- Default: Missing payments negatively impacts credit and risks car repossession.

- Prepayment Penalty: that you might need to consider if paying off early, says Quick Car Finance.

- Ask Questions:

- Clarify any doubts. Understand the consequences of defaulting or paying early, understand the small print and don’t hesitate to seek professional advice.

Once you have all the details, you’ll be able to make informed decisions, and have a smooth car-buying experience.