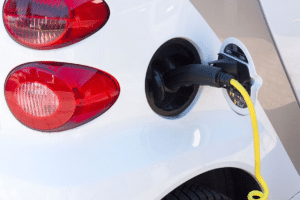

What is a telematics box ?, also sometimes to referred to as a black box, could help save you money and reduce the cost of your car insurance, while helping to prove you’re a safe driver all at the same time.

These boxes are essentially an electronic device that you can have fitted into your vehicle, which will record and monitor your performance as the driver, according to Think Insurance. By having a telematics box, it will calculate your premium based on how you drive, says Which so that your insurance company has data to understand your driving behaviour and whether you are driving safely.

How does a telematics box work?

It doesn’t matter whether you’re an experience driver or a young, inexperienced driver, you might decide to opt to have a telematics box to help you cut the cost and bag yourself some cheap car insurance. The car insurance world can be a tricky one, and no two black box policies are the same, according to USwitch. However, there are some features that set telematics insurance policies apart compared to a standard car insurance policy.

Black box car insurance uses GPS signals to collect information about your driving and measure your driving behaviour. The data that it collects is then sent to your insurance company, says ICompario and as the driver you should also be able to view your information and driving score, on your online portal.

The box itself is usually quite small and fitted out of sight in your car. Once installed, it will record how you drive, paying close attention to your driving style and it will also provide you with a driving score, which takes into account things like your cornering, braking and acceleration. On top of this, it can also come in handy for providing location information which is crucial if your car is ever stolen.

Does black box car insurance work with any car?

Generally, black boxes can be fitted to most cars. The installation and activation of a black box tends to be quick and easy, according to Carrot Insurance and it can be tucked away neatly out of sight.

However, with that being said, there are some cars that you might find cannot support a black box, particularly if the car is very old, according to Finder. This is why it’s probably worth checking if your car is suitable for black box insurance before taking out a policy.

What data will my telematics box collect?

Insurance companies love collecting telematics data, because, with this information, they can track your behaviour and asses your risk.

The telematics box collects various different pieces of data, and each insurer will have slightly different metrics for deciding how safe of a driver you are according to Which, such as:

- If you accelerate or break harshly

- If you turn a corner sharply

- How many miles you’re doing

- How many trips you do

- The speeds you’re driving at and whether you are within the speed limit

Your driving behaviour tends to be monitored, in most cases, across a variety of journeys to provide you with an average driving score. So whether you’re a young driver or just generally looking to see if you can reduce your insurance premium, a telematics box could be the way forward.

How much does telematics insurance cost?

Telematics insurance might not be as cheap as you might think. For example, if the telematics device records that you’re speeding or braking too harshly on a regular basis, this could increase your insurance premium, rather than helping you to decrease it.

Similar to many insurance companies, black-box insurance companies are likely to take into account various different factors, which could affect how much your black box insurance costs. From a change of vehicle to box disconnection or removal, black box insurers generally tend to charge the same fees as traditional car insurers.

Is a telematic policy cheaper than a traditional insurance policy?

According to Finder’s research, motorists can typically save between 8% and 26% on their premiums with a black box.

Given that car insurance is such a personal thing, the best thing you could probably do is to get a quote to be able to see whether it could save you money. It’s been reported by Uswitch, that for many, black box insurers offer cheaper alternatives to traditional car insurance.

It’s clear that from the perspective of Uswitch, some insurers are of the view that if you’re willing to have a telematics box, you’re probably less likely to take risks, and drive more cautiously so you’re likely to receive a lower price than traditional insurance providers.

A telematics box is quite popular amongst young drivers, with some insurance companies even offering lower prices for drivers under 30 who get one of these boxes fitted. Young drivers can save the most with a box in their vehicle, but even more experienced drivers can get potential savings of over £100 a year, says ICompario.

If you’re struggling and you’re not sure if having a telematics box will save you money, you can always ask your insurance provider if having a box installed would lower your costs. If you do get a telematics box installed, the amount you can save will depend on your driving score. The better your score, the lower your insurance costs.

Can a telematics box help me in an accident?

Some telematics devices are really clever and can even detect when your car is involved in a crash. It can provide evidence, and illustrate what happened, meaning it could potentially help you settle a dispute with another driver, according to Think Insurance.

For example, your insurance company may be able to pull the data from the telematics box to help determine the speed of the vehicle you were driving before the crash, during, and after, which you could then use as evidence within a claim.

Insurers can also use the telematics data to determine the cause of an accident and who was at fault, says Uswitch, which could make the claims process easier.

Jamjar.com makes selling your car quick, easy, and hassle-free. By comparing offers from a trusted network of UK car buyers, you get the best price without the stress of negotiating or haggling. There are no hidden fees, no obligation to sell, and the entire process is 100% online. Whether your car is nearly new or well-used, Jamjar helps you sell it fast and for a fair price—saving you time and effort.

SELL YOUR CAR HERE: https://www.jamjar.com/sell-my-car/