We’ll explain everything you need to know about drive-away insurance, including what it is, when you might need it, and how to get it…

What is drive-away insurance?

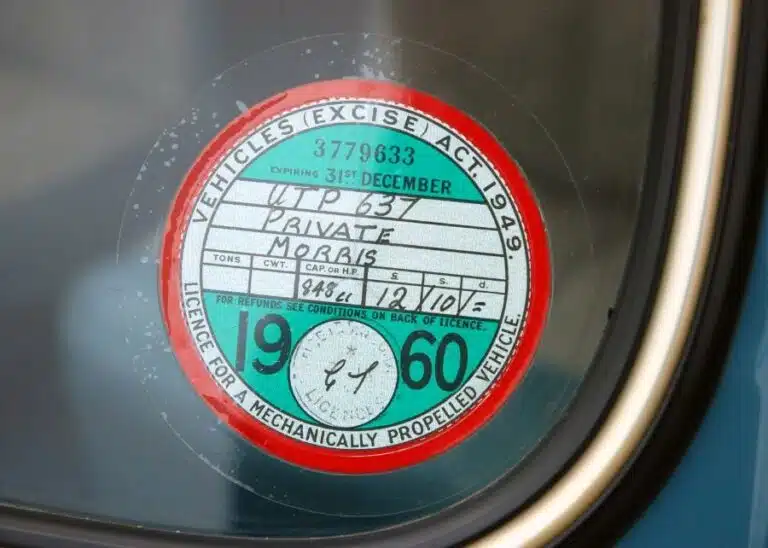

Drive-away insurance is a form of temporary car insurance that serves a specific purpose allowing you to legally drive away in a newly purchased vehicle. Drive-away insurance provides short-term coverage for the period immediately after you’ve acquired a new car.

It allows you to drive the vehicle from the place of purchase (such as a dealership) to your home or desired location. Typically, this coverage is used when you haven’t yet arranged an annual car insurance policy, says Tempcover.

Drive-away insurance is great if you’ve just bought a car. Drive-away insurance ensures that you’re covered during that initial journey. Whether you’re borrowing a friend’s car, demonstrating an unaccompanied vehicle, or using a courtesy car, drive-away insurance provides immediate coverage.

When do you need drive-away insurance?

Drive-away insurance is essential in specific situations when you’ve just purchased a new vehicle.

Here are the scenarios where it becomes relevant:

- New Car Purchase:

- When you’ve bought a brand-new car, drive-away insurance ensures you’re legally covered during the initial journey from the dealership to your home.

- It allows you to drive your new vehicle without delay, even before arranging an annual car insurance policy.

- Temporary Need:

- Borrowing a Friend’s Car: If you’re borrowing a friend’s car for a short period, drive-away insurance provides immediate coverage.

- Demonstrating an Unaccompanied Vehicle: For instance, if you’re showcasing a car to a potential buyer, drive-away insurance ensures legal coverage during the demonstration.

- Courtesy Car Usage: When your car is in the repair shop, a courtesy car provided by the garage can be insured with drive-away coverage.

Overall, drive-away insurance ensures a smooth transition for your new vehicle, allowing you to hit the road legally without delay!

How much does drive-away insurance cost?

Drive-away insurance provides short-term coverage for specific situation. The cost of drive-away insurance varies based on several factors:

- Duration:

- Drive-away insurance can be as short as 1 hour, up to a maximum of 28 days, says Temp Cover.

- The exact duration you need coverage for affects the cost.

- Make and Model of the Car:

- The type of vehicle you’re insuring plays a role.

- More expensive or high-value cars may have higher premiums.

- Personal Circumstances:

- Your age, driving history, and license points impact the cost.

- Younger drivers or those with recent accidents may pay more.

- Average Costs:

- On average, according to Confused.com short-term cover costs approximately:

- £20 per hour

- £38 per day

- £114 per week.

- On average, according to Confused.com short-term cover costs approximately:

Drive-away insurance offers flexibility—you pay only for the coverage you need during that crucial transition period. To get an accurate quote, you can always shop the market and find an insurance provider to suit you.

What are the benefits of drive-away insurance?

According to Day Insure, drive-away insurance provides several advantages when you need short-term coverage for your vehicle:

- Immediate Coverage: Drive-away car insurance can start within 15 minutes, which is essential in emergencies or when you want to drive your new car home right away.

- Business Use Coverage: Some insurers could insure you for business use. For instance, if you’re picking up a new car for work, this insurance ensures you’re protected.

- Flexibility: While annual insurance can start on the same day, drive-away cover allows you to shop around for the best deal once you’ve driven your new car home.

- Temporary Arrangement: If you’ve purchased a second-hand car and need to drive it immediately, or if you’re collecting a new car for a friend, drive-away insurance can be prearranged and scheduled for the time you need.

- Competitive Prices: Insurers can provide drive-away insurance at highly competitive prices for short-term coverage.

Drive-away insurance is a convenient option when you’re waiting to explore annual motor insurance but want to drive your new car home right away!

Final word on drive-away insurance

Some drive away insurance policies cover your vehicle as you drive it from the dealership to your garage. Other drive away insurance policies completely cover your vehicle (just like an ordinary full coverage policy) over a short period (typically five to 10 days).

You can buy drive away insurance from a car dealership at a higher price. Alternatively, you can contact your insurer to verify you have drive away coverage on new vehicles. Or, shop around for drive away insurance from short-term car insurance companies in your area.